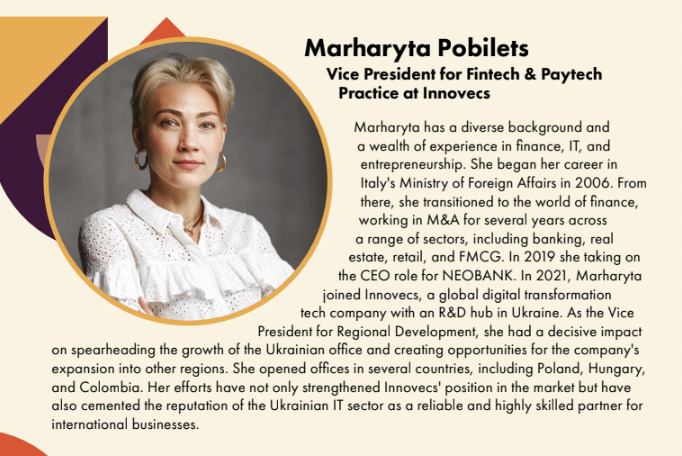

My name is Mariia Gerasymiak, and I would like to share the inspiring story of our teammate Marharyta Pobilets, VP of FinTech & PayTech Practice at Innovecs.

The reason for preparing this article was fantastic news. Marharyta is on the list of TOP-50 Most Influential Women in FinTech 2023 by UAFIC (Ukrainian Association of FinTech and Innovation Companies).

This conversation prompted my reflections on cutting-edge technologies, the rapidly changing world, and diversity issues in FinTech. During our interview, I once again realized that amazing and inspiring women work here with Innovecs.

— Congratulations on being recognized as one of the most influential women in FinTech 🙂 Can you please tell us about your background — what knowledge and achievements allowed you to lead the direction of FinTech & PayTech Practice at Innovecs?

My journey through various sectors highlights the eclectic nature of my experiences. Initially, I set foot in the realm of diplomacy, starting with Italy’s Ministry of Foreign Affairs back in 2006. My path took a twist, landing me amidst the financial world, where I delved into M&A across diverse sectors, from banking to FMCG. Memorable moments? Contributing to notable acquisitions in PJSC Bank of Cyprus and others, with transactions amounting to billions in UAH.

Source: TOP-50 MOST INFLUENTIAL WOMEN IN FINTECH 2023, UAFIC

Fast forward to 2019, and the allure of technology beckoned. Taking the helm at NEOBANK, a digital banking solution aimed at Ukrainian SMEs, was transformative. In my mind, alongside the innovative team at Concord FinTech Solutions, we shaped a pivotal MVP, ensuring financial solutions were within the reach of regional businesses.

By 2021, my adventure led me to Innovecs, a formidable player in the digital transformation arena. Undertaking responsibilities as the Vice President of Regional Development, I embarked on expanding our footprint to Poland, Hungary, and Colombia. As the Vice President of FinTech & PayTech Practice, it’s not just about strategizing and executing, but invigorating sales too. I’m driven to bolster Innovecs’ standing and shine a spotlight on Ukraine’s tech prowess for global collaborations.

— How do you see the current state of the FinTech industry and its trajectory over the next several years?

The State of FinTech Q2 2023 report by CB Insights paints a vivid picture. The funding fell 48% QoQ to hit $7.8B in Q2’23. So, we’re seeing a pronounced slowdown, with funding receding to levels reminiscent of 2017.

The narrative of decreasing deals and mega-funding underscores the changing dynamics. The number of deals dropped for the fifth quarter in a row, ending at 845. Mega-round funding (those over $100 million) fell to $2 billion in Q2’23. And once again, it is the lowest result in six years.

While gloomy for most, regions like Latin America and the Caribbean offer a glimmer of hope, shooting up 150% from Q1’23 to Q2’23.

Interestingly, Paytech, our chosen domain, mirrors these fluctuations, with payment firms seeing a significant funding plunge.

Funding for payment firms experienced a 75% QoQ decline, marking the largest plunge among all Fintech domains. The sector also observed a 14% reduction in deals, concluding at 148.

Economic undercurrents, like the war in Ukraine and the looming recession chatter, coupled with global financial indicators, understandably sway investor sentiments, recalibrating the industry’s outlook.

— Technology is rapidly changing the financial landscape, isn’t it? Zooming out, what’s buzzing in the industry?

I would like to highlight 3 fields: Open banking, Embedded finances, and Digital payments. From the inaugural online credit card purchase in 1994 to the advent of SMS mobile payments, the landscape is pulsating with big tech at its core.

Big tech plays a pivotal role in digital payments today. For instance, Paypal boasts over 250 million users, Apple Pay has 32 million users, while Google Pay and Samsung Pay account for 32 million and 16 million users, respectively. In 2022, the B2B Payment Market had a valuation of USD 994.20 billion and is anticipated to hit a mark of USD 2146.70 billion by 2030, growing at a CAGR of 10.10% during the forecasted timeline.

We’re witnessing a paradigm shift, with alternative payment methods taking center stage, thanks to technological strides and shifting consumer expectations. Over 60% of the world’s population is anticipated to adopt digital wallets by 2026, with digital wallet expenditures predicted to surpass 10 trillion USD by 2025.

To me, Open Banking encapsulates the essence of financial evolution. It’s about fostering collaborations and data exchanges through APIs. The regulatory frameworks, like the EU’s PSD2 which will be replaced by PSD3 shortly, ISO 20022, PSR, and The Financial Data Access and Payments Package (FIDA) are symbolic of empowering users with choice and driving competition within FinTech companies.

Yet, it’s vital to acknowledge the stumbling blocks, such as the lopsided incentive structures for traditional banks. A primary limitation of the PSD2 initiative is the obligation for banks to offer open API access, yet they don’t benefit from the value generated by third parties using their data and resources. Without avenues for profit, banks are often unmotivated to extend beyond the basic required APIs.

Embedded and Entwined Finance is changing the financial narrative. It’s about weaving finance seamlessly into our daily experiences. The Money 20/20 conference accentuated the significance, emphasizing the transition from mere transactions to contextual interactions. Examples abound, with platforms like Elon Musk X’s strategy illustrating the future trajectory because he began applying for regulatory licenses across the US and designing the software required to introduce payments across the social media platform.

Embedded Finance is metamorphosing into Entwined Finance, characterized by deeper integrations, reciprocal shared data, and co-created and maybe co-branded products.

— Why do financial companies choose Innovecs as their technical partner?

We keep pace with all new technologies emerging in financial software development and easily adapt to changes that take place in the industry.

Innovecs’ engineers utilize the latest technologies across the industry, such as blockchain, big data, and machine learning, to deliver high-quality FinTech solutions on time and budget.

Also, it is important to note that we handle risk mitigation. Innovecs has robust security protocols and compliance measures in place, ensuring that sensitive financial data remains protected and regulatory standards are met.

— Gender diversity is a pressing issue in the technology and financial industries, isn’t it?

I suppose, we still can see the concerning pattern emerging in the tech space. Women, while making their mark, remain underrepresented, especially in senior roles.

Recent UK data reveals a dip in female tech participation. It’s a poignant reminder of the challenges we still face and the journey ahead. According to a new analysis of UK National Statistics data, in 2021, women made up 22,7% of the entire workforce in the tech sector. However, this figure saw a slight decline to 20,1% in 2022.

On the bright side, the total count of tech professionals, encompassing both employees and contractors, rose by 4.1%, going from 1 827 851 in 2021 to 1 903 671 the following year.

Also, if we talk about the positive aspects: I can state that women who have a background in banking and finance have an advantage in switching to FinTech. FinTech stands at the unique crossroads of two complex industries, making it a challenging domain to fully grasp. Many female professionals in this space hail from the banking sector. It’s essential to combine this background with a keen understanding of financial market trends, demand, and competitors.

Only with this combined knowledge can one truly conceive a meaningful technical product. In this realm, technology acts more as a tool, an instrumental piece in the puzzle that aims to bridge traditional financial practices with modern solutions.

The final list includes 50 women who are recognized as the most influential in

fintech industry of Ukraine

Source: TOP-50 MOST INFLUENTIAL WOMEN IN FINTECH 2023, UAFIC

— What steps in your mind can be taken to further promote diversity?

I do believe, that a diverse team brings a broader range of perspectives, which can lead to more innovative solutions and a better understanding of a wider customer base. What can we do here?

Firstly, in my opinion, raise awareness and make education accessible. Hosting workshops, diversity training, and awareness campaigns can help change corporate culture from the ground up. Also, implementing mentorship programs where women early in their careers can benefit from the guidance of more experienced professionals. Offering training and upskilling opportunities can also make a significant difference.

The crucial thing is flexible working conditions. This can be particularly impactful for women, who often juggle professional roles with caregiving responsibilities.

Another important step to overcome the status quo — is networking opportunities for women. Encouraging participation in women-centric FinTech events or networks can provide crucial industry connections.

— Congratulations, Marharyta, on your well-deserved recognition as one of the TOP-50 Most Influential Women in FinTech 2023 by UAFIC. Your contributions to the industry are both commendable and inspiring.

In wrapping up this discourse, our discussion has profoundly rekindled the contemplation on the evolving landscape of cutting-edge technologies, the swift transformations we see in today’s world, and the ever-pertinent matters of diversity in the FinTech sector.

The interview is a poignant reminder of the incredible and awe-inspiring women who grace the halls of Innovecs, consistently making a difference. As we continue to embrace change, it’s pivotal to acknowledge and celebrate the diverse minds steering us into the future.